Foundation Investments provides direct access to institutional-quality multifamily apartment investments. As a limited partner, you can enjoy tax benefits while leveraging our in-house expertise. We thrive to provide an average annual IRR of 18% over a 3-5 year hold period to our Investors, based on conservative underwriting.

Why Invest in Multifamily Real Estate?

Strong Returns

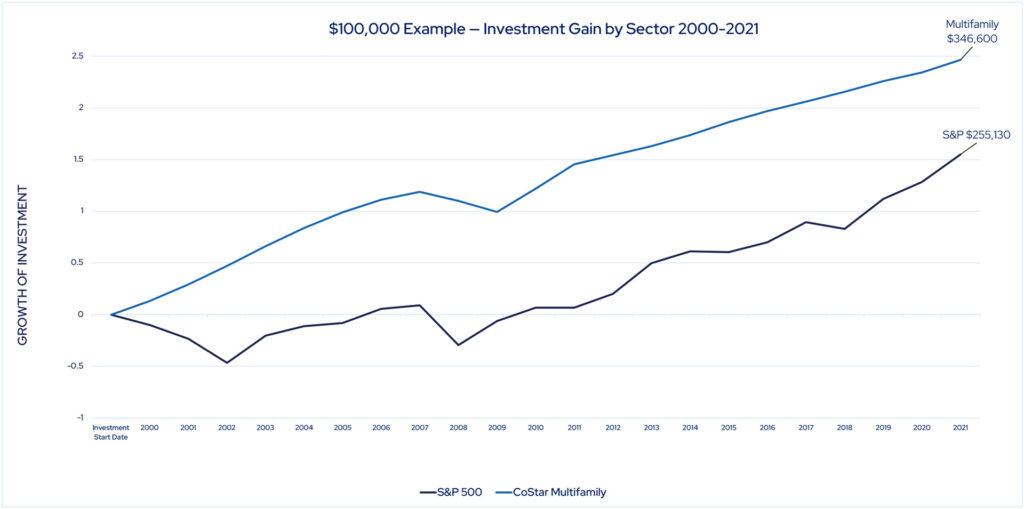

Multifamily real estate investments have consistently delivered strong returns, often outperforming other investment options like bonds, public REITs, and even the S&P 500 over the past two decades.

Greater Stability

Housing is a basic human need, which makes multifamily properties more resilient during economic downturns. Private multifamily developments are generally less volatile compared to public assets like stocks and REITs.

Tax Benefits

Real estate investors, especially those involved in limited partnerships, can benefit from unique tax advantages. Programs such as Opportunity Zones offer significant tax incentives that enhance overall investment returns.

Diversification

Multifamily investments provide valuable diversification to an investment portfolio. Combining various asset types, including liquid and longer-term investments, helps protect against economic downturns while offering the potential for significant returns during favorable market conditions.

BY THE NUMBERS

100+

Properties

15,000+

Units

$1 Billion

Since 2006

Our Investment Strategy

At Foundation Investments, we focus on acquiring and maximizing the value of single-family and multi-family properties. Our investment strategy is built on thorough market analysis, strategic acquisition, and effective property management to ensure optimal returns.

Strategic Acquisition

We identify high-potential properties through comprehensive market research and analysis, ensuring each investment aligns with our goals for strong returns and stability.

Value-Add Approach

We implement targeted improvements and efficient management practices to enhance property value and performance, ensuring our investments yield the highest possible returns.

Partnerships

We collaborate with experienced property management and asset management companies to leverage their expertise, maximizing the value and performance of our properties.

Investment Types

Affordable Housing Solutions

We specialize in identifying and investing in affordable housing opportunities, such as LIHTC, Project-Based Section 8, and market rate properties with tenants on Section 8 vouchers. These investments not only offer strong returns but also contribute to community development and stability.

Market-Rate Investments

Our portfolio includes market-rate properties that provide steady cash flow and appreciation potential, ensuring a balanced and diversified investment strategy.

OUR RETURNS*

15-20%

Targeted Internal Rate of Return

8-12%

Average Annual Cash on Cash Return During Operations

19.7%

Average Net IRR to the Investor

Get Started

Ready to invest with Foundation Investments?

Schedule an appointment today to discuss your investment goals and learn more about our current opportunities.

*Targeted returns refer to goals that may or may not be achieved based on various assumptions that may or may not materialize. Securities are available only to verified accredited investors who can bear the risk of losing their investment.